When it comes to buying an HDB flat, understanding the different housing loan options is important in planning for the financing of your home. In this article, we share with you the differences between a housing loan from HDB and a Financial Institution (FI), and the packages offered by the various FIs that you can choose from when you apply for an HDB Flat Eligibility (HFE) Letter on the HDB Flat Portal.

Housing Loan Options

You may apply for a housing loan from HDB or FIs regulated by the Monetary Authority of Singapore for the purchase of new flats from HDB or resale flats. Each option comes with its own eligibility criteria and conditions.

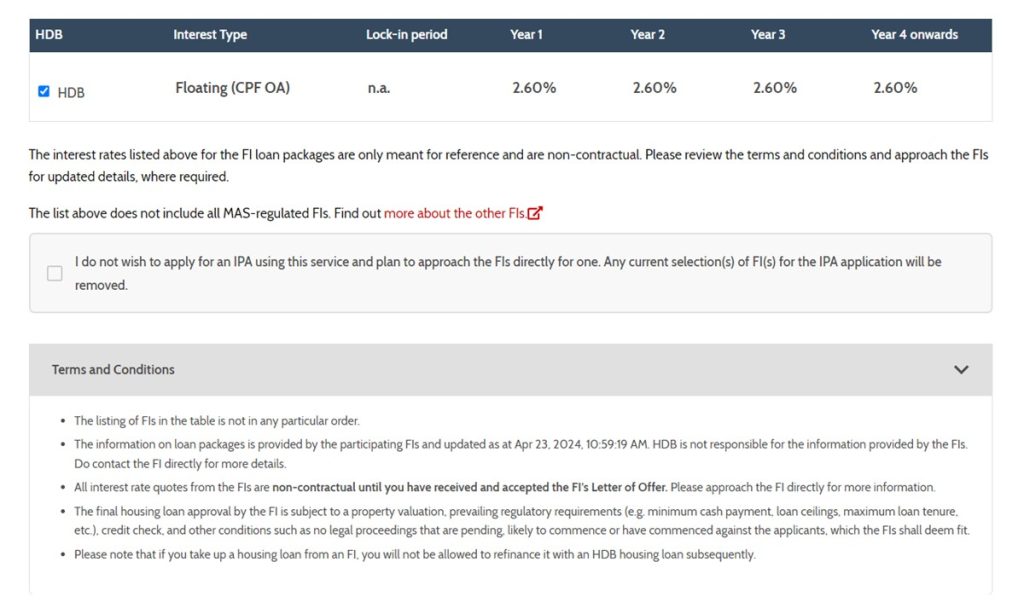

HDB Housing Loan

The HDB Housing Loan is a financing option offered by HDB with the following advantages:

- A relatively stable interest rate pegged at 0.1%-point above the prevailing CPF Ordinary Account interest rate (reviewed quarterly or until the you reach 65 years of age; whichever is earlier).

- The flexibility to change the repayment period if the situation calls for it.

- A lower downpayment of 20% of the flat purchase price or valuation (whichever is lower); as compared to bank loans with a downpayment of 25% of the flat purchase price or valuation, of which 5% must be paid in cash.

An HDB loan may be suitable for those seeking a stable monthly payment plan. Do take note of the following:

- You must use your CPF savings to pay for the flat purchase (you have the option to retain up to $20,000 in CPF savings per flat buyer), before the HDB housing loan can be granted. This is to minimise the amount of housing loan required for the flat purchase.

- Each household can only take up to two HDB housing loans collectively.

- If you are taking a second HDB housing loan, you can keep $25,000 or 50% of the cash proceeds, whichever is greater, from the disposal of your last sold flat/ property. The remaining cash proceeds and full CPF refund will be used to reduce the second HDB housing loan amount.

?Remember to check if you and all persons applying for an HDB loan meet the eligibility conditions. The eligibility conditions include the applicants’ citizenship, household status, income ceiling, credit assessment criteria, the remaining lease of the flat and other criteria.

Housing Loan from Financial Institutions (FIs)

A housing loan from FIs offers the following advantages:

- Greater flexibility in terms of interest rate packages and loan amount.

- Longer loan tenures of up to 30 years, compared to the loan tenure of up to 25 years for HDB housing loan.

- No requirement on usage of CPF before disbursement of housing loan.

Housing loans from FIs are suitable for those who prioritise flexibility and are willing to research and explore various loan packages offered by different banks for better deals. Nevertheless, do check the terms and conditions before you commit to an FI loan.

Here is a handy guide on the differences between a loan from HDB and an FI:

| HDB Loan | Loan from an FI | |

| Downpayment | At least 20% of the purchase price, which can be paid in full using your CPF Ordinary Account (OA), with cash, or with a combination of both | 25% of the purchase price – with 5% payable in cash and the remaining 20% payable in cash or your CPF OA savings |

| Maximum loan amount | Up to 75% of the purchase price for new flatFor resale flats, it is 75% of the resale price or market valuation (whichever is lower) | Up to 75% of bank evaluation or purchase price (whichever is lower) |

| Loan Period | Up to 25 years | Up to 30 years |

| Interest Rate | 2.6% per year (pegged at 0.1% above the prevailing CPF OA interest rate) | Varies between banks and may change with market conditions |

| Early Repayment/ Refinancing | No penalty if you wish to pay off your loan early Option to refinance your loan with a bank anytime | Subject to the terms and conditions of the various banks |

| Conditions to take a second HDB housing loan | Before you can be granted a second HDB housing loan, you must first use the full CPF refund and part of the cash proceeds^ received from the disposal of your last owned HDB flat/ private residential property, to pay for your new flat purchase. ^You may keep $25,000 or 50% of the cash proceeds (including the cash deposit received), whichever is greater. HDB will take into account the remaining cash proceeds when determining the second HDB housing loan amount. | Not applicable |

?You can refer to our A Guide to Applying for an HDB Flat Eligibility (HFE) letter for a holistic understanding of your housing and financing options before you embark on your home buying journey.

Comparing Different Financial Institutions’ Loan Packages

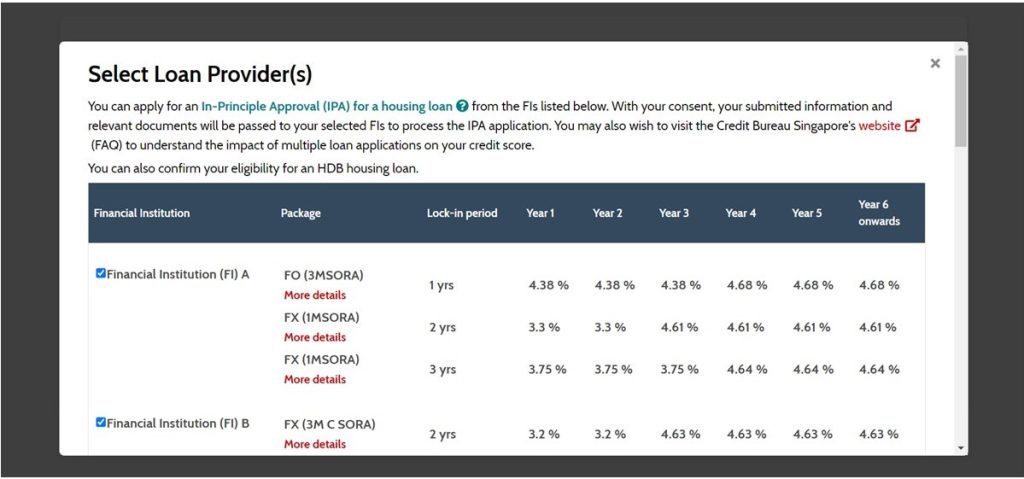

To help you better understand your financing options, the HDB Flat Portal offers an Integrated Loan Application Service for buyers to easily compare a loan from HDB and Fis, as well as the various packages offered by the participating FIs:

- DBS Bank Limited

- Hong Leong Finance Limited

- Maybank Singapore Limited

- Overseas-Chinese Banking Corporation Limited

- Sing Investments & Finance Limited

- United Overseas Bank Limited

?Simply make use of HDB’s financial calculators to work out your budget and payment plan, with housing loan estimates from both HDB and the FIs.

Checking Your Eligibility for a Housing Loan from the Participating FIs

You can compare the loan packages of participating FIs and submit an application to the FIs for In-Principle Approval (IPA) when you apply for an HDB Flat Eligibility (HFE) letter.

Here’s how:

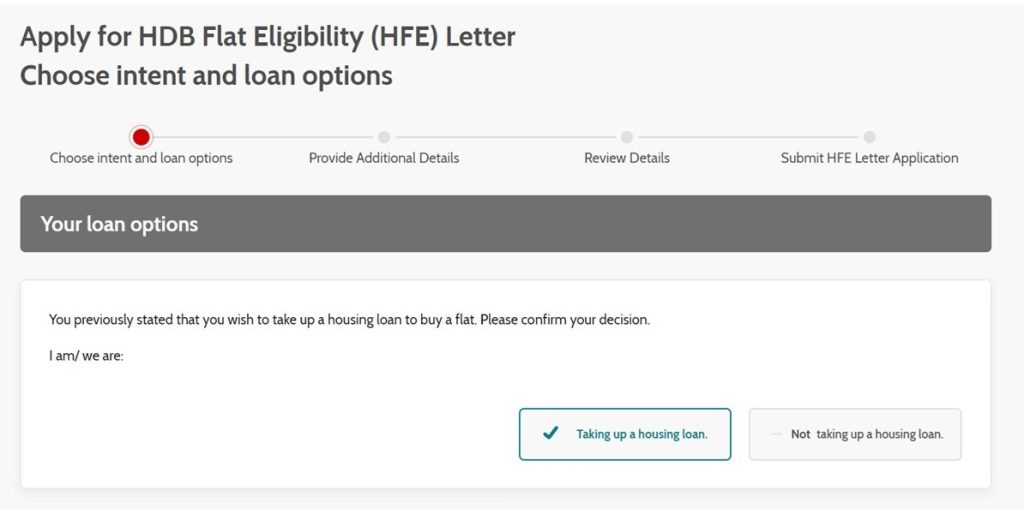

- In your HFE letter application, select the ‘Take up a housing loan’ option.

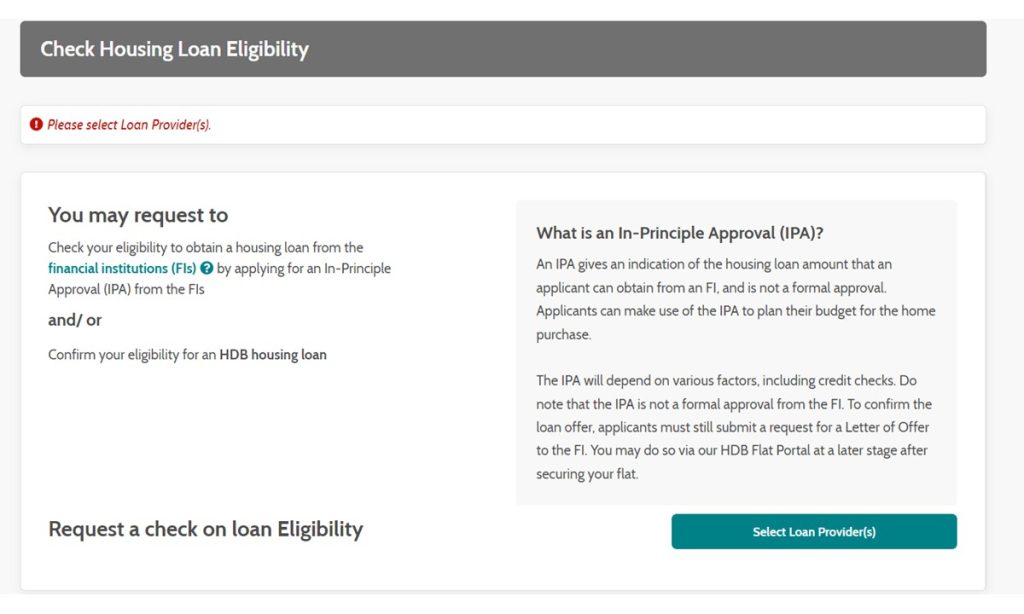

- Scroll down to the ‘Check Housing Loan Eligibility’ section.

- Click on the ‘Select Loan Provider(s)’ button and a window will pop up. This window provides a list of FIs where you can compare the different FIs’ loan packages as well as confirm your eligibility for an HDB loan.

Once you have clicked on the ‘Continue’ button in the pop-up window, the list of chosen FIs and HDB housing loan will be reflected on your HFE letter application. Follow the steps on the HFE letter application form to submit the necessary documents and complete your HFE letter application.

After the HFE letter application is submitted, the IPA application will be sent to the selected FIs.

Confirming a Loan Offer from a Participating FI

You will need to obtain a valid Letter of Offer (LO) to confirm the loan offer from an FI before you can:

- Sign the Agreement for Lease for a new HDB flat

- Exercise the Option To Purchase (OTP) for a resale flat

If you had earlier obtained an IPA through the integrated housing loan application service, you will be guided to submit a request for the LO on HDB Flat Portal after:

- Selection of flat; for those buying a flat from HDB

- Request for value; for those buying a resale flat

Helping You Make Informed Choices

When deciding between an HDB or an FI loan, consider your financial circumstances, long-term plans, risk tolerance, and interest rate preferences. Be sure to thoroughly research and compare loan packages to ensure the chosen option aligns with your individual needs.