Note: The information in this article has been updated on 27 August 2024.

Are you looking to buy a resale HDB flat, but unsure about the process? We’ll guide you through the key milestones when buying an HDB flat from the open market.

| Content |

| Step 1: Apply for an HDB Flat Eligibility (HFE) letter Step 2: Plan your finances Step 3: Search for a resale HDB flat Step 4: Obtain an Option to Purchase (OTP) from a seller Step 5: Submit a Request for Value (if needed) Step 6: Submit resale application |

Step 1: Apply for an HDB Flat Eligibility (HFE) letter

Before you begin, apply for an HFE letter through the HDB Flat Portal to confirm your eligibility to buy a resale flat, as well as the CPF housing grants and HDB housing loan amount you can receive.

? First-timers buying resale flats can receive up to $230,000 in grants. Learn more in our guide to CPF housing grants.

If you wish to take a housing loan from a financial institution (FI), you may also concurrently apply for In-Principle Approvals (IPA) from the participating FIs when you apply for an HFE letter.

Your HFE letter will be valid for 9 months, and you must have a valid HFE letter when you:

- Obtain an Option to Purchase from a flat seller

- Submit a resale application

Learn more in our step-by-step guide on applying for an HFE letter.

Step 2: Plan your finances

With a better idea of your housing and financing options, be sure to set aside time to do your sums before you dive into searching for a resale flat.

You can calculate your flat budget by adding up the CPF housing grants, housing loan amount, as well as your CPF and cash savings. Don’t worry if math makes you sweat – you can use HDB’s budget calculator to retrieve information from your approved HFE letter to help you work out your budget.

Step 3: Search for a resale HDB flat

With your approved HFE letter and sums all worked out, it’s time to look for an HDB flat that meets your budget and needs. If you’re not sure where to start, check our article on what to look out for when buying a resale HDB flat.

Once you have a better idea of what you are looking for, you can either engage a real estate salesperson to help you with your search, or look through resale flat listings online yourself.

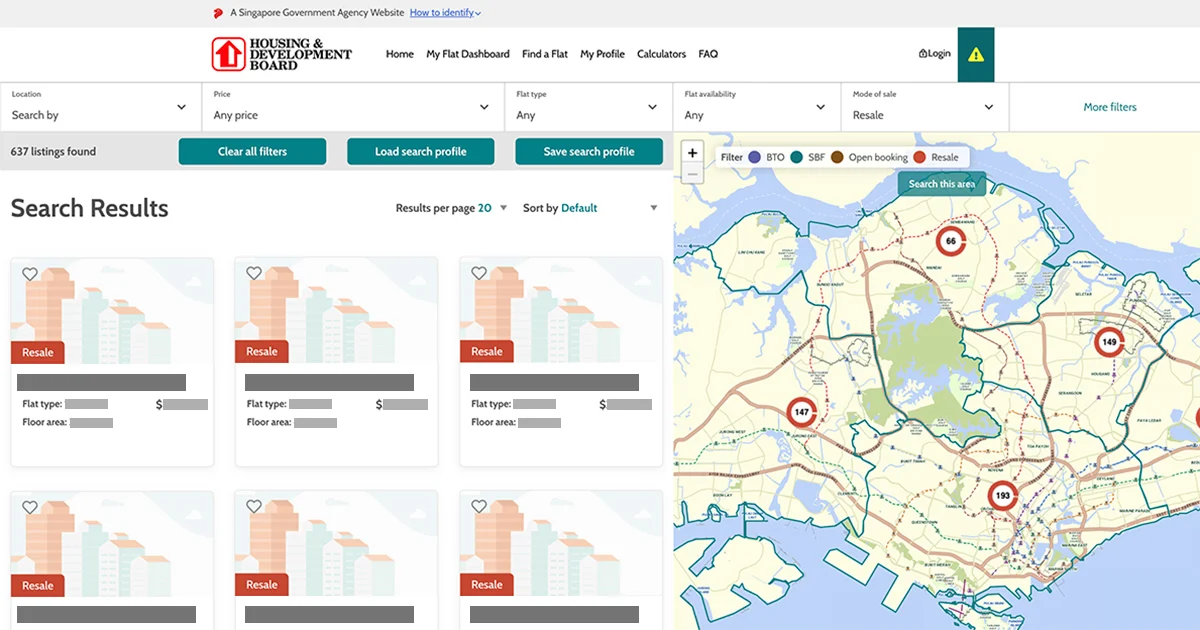

For example, you can use the HDB Flat Portal to view resale HDB flats listed for sale, alongside upcoming new BTO flat projects and any new flats on offer.

? The HDB Flat Portal has plenty of useful features for buyers, including filters and search profiles to help you quickly find flats that meet your preferences. Read more in our article on the Resale Flat Listing service!

Step 4: Obtain an Option to Purchase (OTP) from a seller

Once you have decided on the resale flat that you would like to purchase, you need to obtain an OTP from the seller. The HFE letter has a validity period of 9 months, so do make sure that it’s still valid before you obtain the OTP.

Step 5: Submit a Request for Value (if needed)

If you wish to take up a housing loan or use your CPF savings to finance the purchase of the flat, you will need to submit a Request for Value to HDB by the next working day after the sellers grant you the OTP.

Upon receiving the outcome of the Request for Value, you (the flat buyers) will have to decide whether to exercise the OTP.

Step 6: Submit resale application

Should you decide to exercise the OTP, both you and the seller must submit your respective portions of the resale application on the HDB Flat Portal. Remember that you’ll need a valid HFE letter when you submit your resale application.

If the application is in order, we will notify both you and the sellers of HDB’s acceptance of the application via SMS or email. We will also notify both parties of the resale completion date, which is usually about 8 weeks from HDB’s acceptance of the resale application.

There you have it – you’re just that much closer to getting a resale flat of your own!

Thinking about renovating your resale flat? Be sure to check out our guide to planning your HDB home renovation.