When I bought my HDB flat, I received heaps of unsolicited advice. It seemed like everyone had something to say.

To be honest, it shouldn’t surprise me — nearly 80% of Singaporeans live in public housing, making almost everyone a pseudo-expert.

But of course, not all advice is created equal. With age, I’ve realised that just because something is often repeated, doesn’t mean it makes sense.

Here’s a list of ‘advice’ that falls into this category. We will explore the logic, the origins and of course, why it doesn’t make sense today. At least in our opinion.

#1: “BTO as early as possible to get the most grants.”

Ahh, this is a classic, meant to help you save money on one of the biggest financial expenses of your life.

The logic is this: The younger you are, the less income you make, the more grants you’ll receive.

Amazing?

On paper, yes.

But what many people try to do is to get hitched as early as possible to qualify for an HDB flat. But you risk marrying someone to get public housing before you’re actually ready for long-term commitment.

Our take: You should BTO when you’re ready, not “as early as possible”. Buying a house is a serious financial commitment. Marriage, even more so. Both are not something to rush into blindly simply to get a “discount”.

(P.S. Just look up “BTO breakup stories” for cautionary tales.)

#2: “Borrow as much as possible to max out the loan!”

Here’s a public service announcement: Just because you can borrow $1,000,000 doesn’t mean you need to.

When people advise you to “max out the loan”, they are suggesting that you should just take the maximum amount that the bank is willing to lend you based on your current income, since this allows you to afford more expensive properties.

The logic is this:

- Property prices will always go up in Singapore

- Your income will either stay the same or increase

- Interest rates for housing are low, so this is ‘cheap money’

Our take:

While the logic might seem sound, each point is an assumption, rather than a guarantee. So let’s unpack each assumption one by one.

Firstly, property prices don’t always go up, and your income can stagnate.

Property prices have gone up in the long term, but there are periods where they stagnate, or even decline.

The 1997 Asian Financial Crisis and the 2008 Global Financial Crisis are prime examples; these periods of recession saw mass unemployment and wage stagnation.

Secondly, interest rates won’t always be low.

Many millennials are used to an era of low interest rates — a result of the Global Financial Crisis in 2008. Up till 2022, home loan rates were so low that they were even cheaper than HDB loans.

So if you think 2024’s 3.25% mortgages are expensive, consider that in 1997, interest rates in the 6–7% range were the norm.

Here’s the worst case scenario:

Interest rates go up, your mortgage increases. Your property value drops, and you run out of money because you also lost your job. You try to sell your property to pay off debt, but since the value has fallen, selling it will not be sufficient to cover your loan.

You end up making a huge loss. Very sad.

So, in an era where long-term employment is less and less of a thing, we think it’s prudent to buy within your means instead.

(Yes, yes, I know losing your job might seem unlikely for some, but that’s probably what our parents’ generation thought too. Pride comes before a fall.)

#3: “You should just buy the biggest HDB flat you can!”

The logic is this: You never know what life might throw at you in the future, so pay a little more to secure some space now.

Our take:

We understand the point of view for sure; it’s always good to have options and flexibility. However, the cost of those options and flexibility should also be taken into account.

Shooting straight for five-room HDB flats might seem like the smart thing to do, but they’re also significantly costlier than a smaller flat. So are the renovation and maintenance costs.

So, if you’re intending to remain child-free (or one child, max) and live apart from your parents, does buying a four-room flat instead make financial sense?

The fundamental question here is will the money to acquire extra space improve your quality of life?

Or will the money be better off elsewhere?

We prefer a more modest home; any savings from a smaller home can be used to improve our quality of life. Think trips, investment plans, smaller, less stressful mortgage payments.

#4: “You must buy a house with a good resale value!”

The logic is this:

If you choose a unit well with all the right characteristics, you could potentially fetch a good price for it, if you choose to sell your flat in the open market. Flats with good resale values also tend to be more resistant to market downturns.

Our take:

Look, wanting the option to resell your house is completely valid. However, prioritising ‘resale value’ above everything else – your budget, needs – is a rookie mistake.

If you’re getting a flat based on how desirable it is to others, this means you’ll be paying for it at a premium price. Whether or not you can afford that premium, is a separate question altogether.

There’s also a chance that because of the high price, there might be limited room for appreciation. You might also be ignoring the potential of homes that might increase in value later (for example, due to new infrastructure or amenities built in the area).

Our opinion is not to overextend yourself to buy a flat with “good resale value”, if doing so would be incredibly difficult on you and your finances. In the long term, resale prices are tied to unpredictable and uncontrollable factors (more on this later).

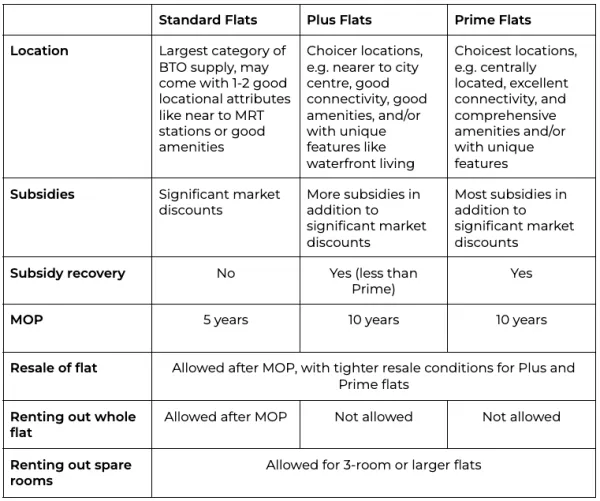

Keep in mind that from October 2024, new HDBs in much-sought-after locations also have restrictions based on the new Standard, Plus and Prime flat classification. Plus and Prime flats, in particular, come with stricter restrictions on MOP, renting, buying and reselling. These also include subsidy clawbacks.

These will need to be factored in when you are purchasing a flat; especially if you want to resell it in the future.

Read more: Why I won’t buy a million-dollar HDB flat (and why you might)

Btw, in case you think there’s some sort of tried-and-tested formula to ‘resale value’, there isn’t. Even freehold, prime-region condos can suffer from price stagnation or losses. Check out these cases here and here.

#5: “Use your HDB flat as a stepping stone.”

A block of HDB flats reaches its five-year mark, and its owners get bombarded by real-estate agents inviting them to sell their flat for profit. Often, sellers are then persuaded to upgrade to a condominium in the name of ‘asset progression’.

This is a familiar phenomenon, repeated across multiple neighbourhoods across Singapore.

The logic is this:

Historically, private property prices have risen faster than HDB prices.

To many people, this means that for every year they don’t “flip” and upgrade, the wider the price gap becomes between their flat and a private property. Therefore, HDB owners will “lose out” in the long term.

This is one reason why many flat owners are urged to sell asap (right after MOP).

(It is true, by the way, that flats sold right after the MOP are often priced higher, as they’re so new — which again ties into this rush to sell it.)

Our take:

Do private property prices rise higher than HDB prices? Of course.

That said, we think there’s some fear-mongering here.

Think about it: By spending less money on an HDB vs a more expensive condo, you free up money to invest in other assets; such as stocks (or even start your own business). HDB owners do not necessarily “lose out”, they just build wealth in a different way.

On the other hand, there are plenty of downsides to putting all your wealth, especially if it’s your primary residence, in a single property.

Just off the top of our heads: there’s overconcentration in a single asset, illiquidity, as well as the high costs to maintain and sell.

Also, it doesn’t matter if you sell at a high point, if you can’t afford your replacement property.

Remember: a rising tide lifts all boats. A boom market makes all properties go up in price. So if you sell high, you also have to buy high. There goes your “advantage” from flipping.

With that in mind, the right time to sell your flat is not immediately after MOP.

The right time is when you’re financially ready.

Let’s address the elephant in the room: HDB resale prices

Yes, resale prices are high now, with record-breaking sales making the news every few months. It’s easy to think that this is the norm.

Some might even be tempted to pin all their hopes on their HDB flats as an investment.

Yet history tells us a different story. As recent as 2013–2019, resale prices were on the decline; people were actually worried!

During the COVID years, resale prices were high due to housing shortages due to COVID-related issues, such as higher construction costs and delays. But these issues are starting to subside.

In addition, in the medium-to-long term, there are other things that may affect resale prices:

- Singapore’s ageing population (reduces demand for housing)

- Low fertility rate (reduces demand for housing)

- New HDB flats hitting the market (increases supply of housing)

- Government policy, regulation and restrictions (could be both)

When we buy an HDB flat, we first and foremost view it primarily as a home. It covers the cost of housing; an alternative to renting.

Is it an asset like many people claim? Yes, we think so. At the very least, we think it’s a stable asset. But just like any other asset, we are hyper aware there are risks involved. This means that even if you think HDB flats are investments, we think diversification is the wise thing to do.

Here’s what we believe:

You can plan your career around trying to maximise your gains through property, but you’ll find that you’ll be able to take less career risks. You might prioritise stability over growth. The status quo, over new skills and new opportunities.

You might think it’s a smart move, but we think that’s doing a disservice to yourself long term.

At the end of the day, Singaporeans pursuing wealth will do good to remember that the main driver of wealth is still yourself.

Stay woke, salaryman.

A message from our sponsor, HDB

If you’re looking to buy a new home, you probably can resonate with the barrage of unsolicited (but well-meaning) advice you’ll get from the people around you.

But it’s also important to consider what your budget and your needs are.

HDB has recently reclassified BTO flats to Standard, Plus and Prime flats, with different subsidies and ownership conditions for each category, with the aim of keeping BTO flats affordable.

To get a deeper understanding of your budget for your new home, check out HDB’s calculator at https://homes.hdb.gov.sg/home/calculator.

And to find out more about HDB’s classification of Standard, Plus and Prime Flats, visit https://go.gov.sg/hdb-spp.