Note: The information in this article has been updated on 27 August 2024.

What are my housing options?

Not sure if you should buy an HDB BTO or resale flat? Here’s an overview of the differences.

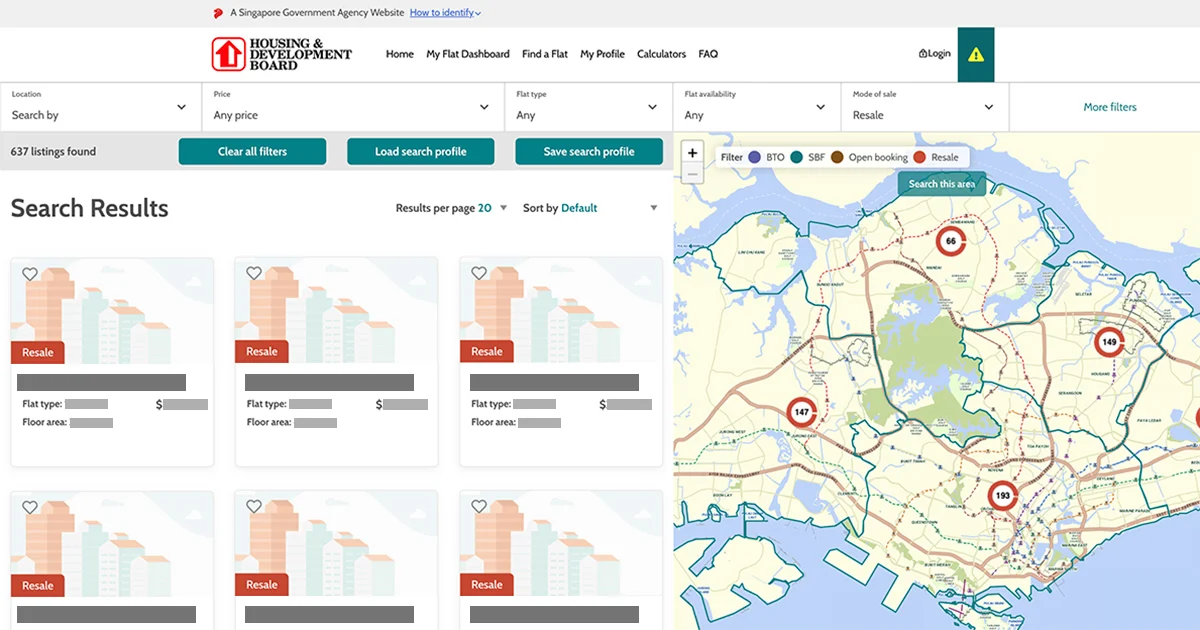

| Flat from HDB (BTO, SBF, Open Booking) | Resale flat | |

| Waiting time | BTO flats Median waiting time is currently 4-4.5 years, HDB aims to bring waiting times down to 3-4 years by 2024. ? Some projects have shorter waiting times of less than 3 years. SBF/ Open booking of flats Completed flat: About 4 months after booking a flat Flats under construction: When flats are completed | About 8 weeks from HDB’s acceptance |

| Location | Varies depending on projects/ balance flats available. Check out our sales launch page for the latest info on upcoming launches. | A wide choice of resale flats across various towns |

| Lease length | BTO flats 99-year lease SBF/ Open booking of flats Varies, depending on balance lease of flat | Varies, depending on balance lease of flat |

| Income ceiling | Up to $14,000 for families Up to $7,000 for singles You may apply for Deferred Income Assessment when you book your flat, if eligible. | No income ceiling. Income ceiling applies for CPF housing grants and/or HDB housing loan. |

| Price | Priced with generous market discounts | Negotiated between buyer and seller. ? Check out HDB Map Services and the resale flat prices e-Service for recent transacted prices. |

| Grants | Up to $120,000 for first-timer families Up to $60,000 for first-timer singles ? See also our guide to CPF housing grants. | Up to $230,000 for first-timer families Up to $115,000 for first-timer singles ? See also our guide to CPF housing grants. |

| How to buy | BTO flats Apply during BTO sales exercise SBF flats Apply during SBF sales exercise Open booking of flats Apply online any time. Applications will be suspended prior to each inject of fresh supply of flats or when all the flats are booked. | Buy from the open market any time. |

What are the steps involved in buying an HDB flat?

Step 1: Apply for an HFE letter

The HDB Flat Eligibility (HFE) letter informs you of your eligibility to buy an HDB flat, receive CPF housing grants, and take up an HDB housing loan. If you are interested in taking up a loan from a financial institution (FI), you can also concurrently apply for an In-Principle Approval from participating FIs when applying for an HFE etter.

You will need to have an HFE letter before you can:

- Apply for a flat from HDB during a sales launch or open booking of flats

- Obtain an Option to Purchase (OTP) from a flat seller for a resale flat, and when you submit a resale application to HDB

The HFE letter is valid for 9 months, so bear in mind its validity and consider applying early!

Learn more in our guide to applying for an HFE letter.

Step 2: Plan your finances

Here’s how you can calculate your flat budget, by summing up your:

- Available cash savings

- Available CPF OA savings

- Eligible CPF Housing Grants

- Estimated housing loan

You can also use HDB’s budget calculator to help you with the math. The calculator pulls information from your approved HFE letter, so you don’t have to enter the information again!

Next steps

Your next steps will depend on whether you intend to buy a BTO or a resale flat. Check out our respective guides to learn more.

| Buying a BTO Flat | Buying a Resale Flat |

| Step 3: Look out for sales launches Step 4: Submit application Step 5: Receive application outcome Step 6: Book flat Step 7: Sign Agreement for Lease Step 8: Collect keys to flat Check out the full steps in our guide to applying for a BTO flat. | Step 3: Search for a resale HDB flat Step 4: Obtain an Option to Purchase (OTP) from a seller Step 5: Submit a Request for Value (if needed) Step 6: Submit resale application Check out the full steps in our guide to applying for a resale flat. |

Check out these other useful guides for first-timers: