The post ‘My Resale Journey: A Change of Scenery After More Than 20 Years’ appeared first on the MoneySmart blog

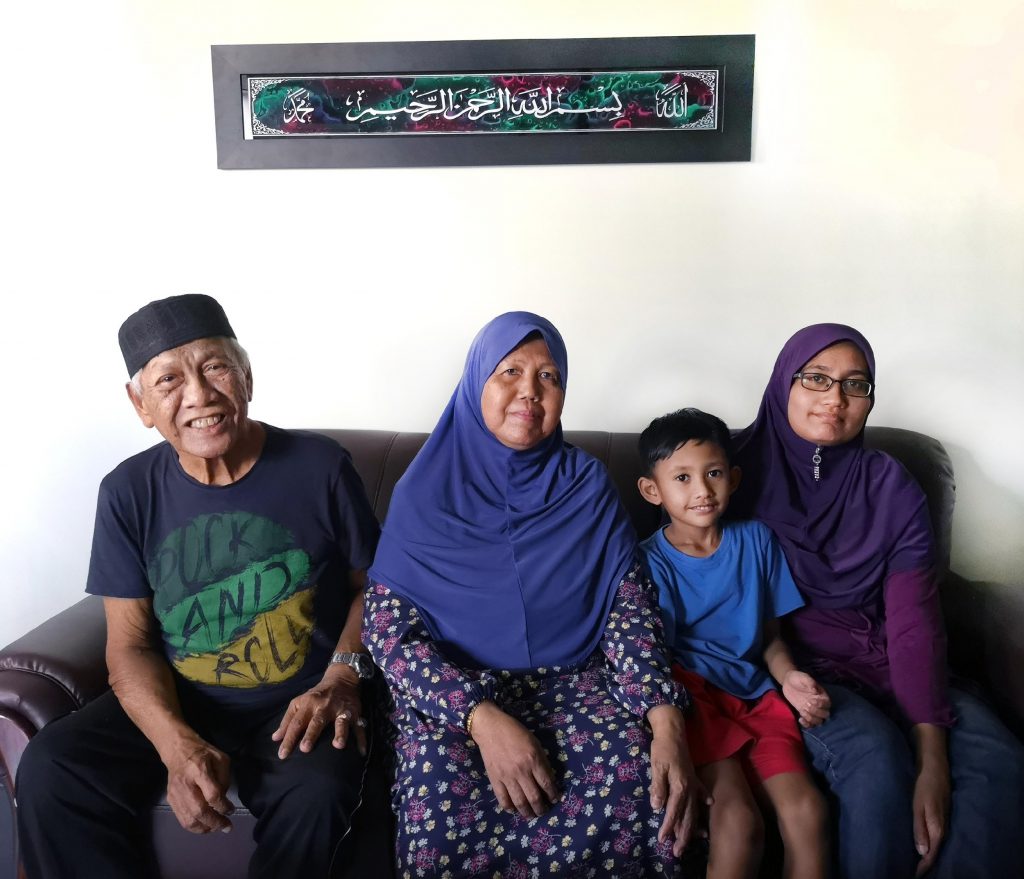

After living in the West for more than two decades, Mr Bactarudin bin Launon and his wife decided it was time to move.

The couple, who previously lived in a 4-room flat in Jurong West, moved to a 3-room resale flat in Marsiling in January this year. This was in part motivated by the desire to stay closer to their daughter, and also better prepare for retirement by paying off their home loan.

For this final installment of our 3-part series profiling HDB resale flat buyers, we had a chat with Mr Bactarudin about his new home, his experiences as a resale flat buyer and his thoughts on owning a home in Singapore

About the Flat

Owner: Mr Bactarudin bin Launon, 70, married with a daughter who has moved out.

| Location | Marsiling |

| Flat Price | $220,000 (after $20,000 Proximity Housing Grant) |

| Year of Purchase | 2018 |

| Flat Type & Size | 3-room flat/ 76 sqm |

| Remaining Length of Lease | 55 years (as of May 2019) |

| Monthly Mortgage Amount & Loan Tenure | Nil (fully paid after selling previous flat) |

| Renovation Cost | About $20,000 |

Mr Bactarudin and his wife greeted us in the living room of their newly-renovated flat at Marsiling Lane.

Mr Bactarudin, a security guard, was taking two weeks’ off work to recuperate after a fall.

While the couple appeared to have settled in well and seemed familiar with their new neighbourhood, they revealed that they had actually moved in just three months ago.

MoneySmart (MS): Thanks so much for having us here. We understand you used to live in Jurong West. Why did you decide to move to Marsiling?

Yes, we lived in Jurong West for 24 years before moving here. We sold our 4-room flat and rightsized to a 3-room flat.

MoneySmart Tip: Mr Bactarudin and his wife received a $20,000 Proximity Housing Grant, as they moved within 4 km of their daughter. Buyers who plan to take up the Proximity Housing Grant can check online whether the flat they intend to buy is within the 4km radius of their parents or children.

MS: Any reasons for not buying a smaller flat in Jurong?

Jurong is a big commercial area and I find things there becoming more expensive.

We also could not find a 3-room flat in the Jurong area for the same price as our current flat. Together with the fact that we could be closer to our daughter and grandchildren, getting this flat here in Marsiling at the price we bought it for was a natural decision.

MoneySmart Tip: To find out transacted resale prices sorted by different towns and flat types, buyers and sellers can access the median resale prices released every quarter.

MS: Having lived in the west for so long, how are you adapting to your new neighbourhood?

Based on my experience interacting with people, it’s almost the same. Depends on whether you take the initiative to greet them also, because we’re the newcomers here.

My neighbour here, who lives opposite us, talked to me first: “Uncle how are you, where you are from?” and so on. This was the first day after I moved in, and I was doing painting outside when they were leaving for work. The second day, I was once again doing painting outside and they started another conversation with me. I told them I moved here from Jurong, and then asked them more about themselves. That’s how we got to know each other.

MS: Are there any big differences between Marsiling and Jurong West?

I’m quite happy living here and find it comfortable.

Within the flat, I don’t see much difference between this and our old home. Outside the home, one main difference is having to walk further for makan.

The eating places in Jurong West were nearer to home. I could cross the road and have teh tarik. Over here in Marsiling, there is a supermarket, 7-11, and a wet/ dry market. It is further away and we will visit once in a while.

But most of the times, we cook at home so we don’t really go to these eateries that often.

MS: Did you get your current Marsiling resale flat through an agent or did you DIY the transaction?

We bought the flat through an agent who is a relative’s friend. They helped with everything. We just let them do everything. They found the price we wanted.

We viewed quite a few resale flats before making a decision. We did not move into this flat until our previous flat was sold.

MS: How did you finance the flat?

We didn’t take out a loan. The flat is fully paid for, so we do not need to pay any monthly instalments.

As I also needed money for my medical condition, selling the old flat and moving to a smaller one was a financial decision as well.

MS: What about the renovations?

We did our own renovations. I think we spent about $8,000.

His wife interjected that the renovations actually cost about $20,000.

We had to do a little bit of wiring. The bulk of the cost went into renovating the kitchen. We also spent on the flooring, sink, fittings, and buying furnishings.

MS: What are your thoughts on buying and owning a home in Singapore?

I’m from Singapore, this is my place, this is my country, this is where I was born.

Singapore is still where I would prefer to have a home to call my own. I recall some friends who bought a place outside Singapore – it may work for you if money is not an issue. But they were not familiar with the rules and the foreign environment. I have worries on what will happen to them if they don’t like it there and have to find another home if they want to return to Singapore.