My co-founder bought a 3-room resale flat in a mature estate last year for a tidy $430,000 in Marine Parade (before the various CPF Housing Grants).

Personally, I think this is a pretty smart decision, given his income and lifestyle. A 3-room flat (or 4 room) flat also makes more sense compared to a 5-room flat, because:

- Less rooms to clean

- Less money spent on renovation

- Lesser need for so many rooms anyway, if you’re not intending to have kids

That said, conventional home owner wisdom is

to buy the biggest or the most expensive HDB flat based on your budget. I know

couples who don’t earn that much but are considering going all out for HDB

flats in locations like Boon Keng, where the resale prices could be as high as

$900,000.

Yikes.

Today I’d like to present another argument: why you should buy the most affordable flat you can.

Now, I’m going to qualify some stuff upfront.

What we mean specifically is to ‘buy the most affordable flat that meets your needs, not ‘buy the absolutely cheapest flat.’

There is a difference.

Avoid the ‘asset rich, cash poor’ trap that many people fall into

To many traditional Singaporeans, this is the idea of being rich: Own lots of expensive things and live in a big house. This mindset is a key ingredient for a lifetime of debt.

But consider this other definition of being rich: Having enough money and freedom for many experiences – cycling around the world, starting a business, supporting causes you’re passionate about, spending more time with your ageing parents and young children.

We think, in the 21st century, the real marker of wealth is time, mobility and options.

All three cannot be achieved if you’re bogged-down paying for an expensive flat way beyond your means. BUT, they can be achieved if you work on your investments. Which brings us to our next point.

Buying a home beyond your means will limit your investment potential

Okay let’s get one thing clear.

There are generally two types of residential property in this world – property you live in, and property you invest in.

- The first one is where you just live in and don’t make money from. This is your *home*. Even when you sell your home to get cash, chances are you’ll use this cash to buy another home.

- The second is one you try to make money from. This is called an investment.

- Sometimes, these two categories overlap. HDB flats, which are meant to be affordable public housing for homeownership, typically fall in the first category (more on this later).

Sometimes, these two categories overlap. HDB flats, which are meant to be affordable public housing for homeownership, typically fall in the first category (more on this later).

The more money spent on your home, the less money you have for investments (investment property, stocks, bonds, etc). Now, this sounds ridiculously simple, but many will find this hard to understand.

Simplified even further, it looks like this:

- You want to retire earlier: spend below your means on your home, spend more on investments.

- You want to retire at 62 like everyone else: spend within your means on your home, invest as per normal.

- You want to have insufficient retirement funds: spend beyond your means on a home, don’t invest.

Here’s some boring math to drive the point home (pun intended). STAY WITH ME.

Let’s assume you buy an HDB flat and stretch payments across 30 years, at an interest rate of 1.7% p.a. These are what your mortgage payments will look like.

| Property price | Monthly repayment, assuming 1.7% p.a over 30 years |

| $400,000 | $1,419 |

| $600,000 | $2,129 |

| $800,000 | $2,838 |

If you had picked the $400,000 flat over the $600,000 one, you would have $710 more each month for your savings or investment.

This doesn’t seem like much, but let’s look at the opportunity cost of investing the $710 over 30 years.

| Place | Interest rate | Opportunity cost of having $710 invested over 30 years |

|

Under

your mattress/ In a biscuit tin (TWS does not recommend this investment vehicle) | 0% | $255,600 |

| CPF SA | 4% | $486,542 |

| Stock Market (conservative) | 5% | $578,916. |

| Stock market (optimistic) | 7% | $830,311 |

Now, I want to be very clear. We’re not saying that buying a $600,000 or $800,000 flat is a financial disaster.

If your combined household income is like $20,000, go ahead. You can buy pretty much any HDB flat you want and have enough left over to work towards your financial freedom.

But if you and your spouse are the median Singaporean couple earning about the median household income of $9,425, you need to be more cautious.

Which brings us to this.

What’s ‘too much’ to spend on a flat?

To avoid spending too much on a flat, you must know what is too much. Here are two methods you might find useful to judge whether your flat is too ex.

The first is the 3-3-5 rule, popularised by property blogger Property Soul and often criticised for being too conservative.

Following the ‘3-3-5’ means you meet all of the following criteria:

- You should have 30% of your capital ready before you purchase your property

- Your monthly repayments should not be more than ⅓ of your monthly income

- And the property price should not exceed your annual income by 5x

Our suggestion is to use the last rule and then work backwards. It looks like this:

| Your household income | The max price of a flat you should buy | Save this amount before buying | Your max monthly payments |

| $9,425 (median income in 2019) | $565,600 | $169,650 | $3,141 |

| $14,000 (income ceiling for BTO) | $840,000 | $252,000 | $4,666 |

| $16,000 (income ceiling for EC) | $960,000 | $288,000 | $5,333 |

Criticism for 3-3-5

Now, a lot of people find this rule very limiting. “iF i foLlOw ThiS I cAnNoT afFoRd anYthIng,” they say.

My opinion is that the rule is a good rule of thumb, and perhaps their tastes in properties are too exquisite or aspirational.

That said, different strokes for different folks. We’re a page focused on savvy financial decisions, not living in luxury or impressing people. So, use your own judgement.

The second rule we’ve created is a simple one called “follow the crowd”

It follows the same logic you used in secondary school to find out whether you’re keeping up with the syllabus.

If you’re the only one failing a test, you should be worried. But if everybody failed a paper, you’d be relatively safe.

(We’ve lumped all 3, 4, and 5 room flats in the same category because it’s very possible for small families to overextend themselves to buy a 5-room flat when a 3-room would have sufficed.)

Which brings us to this magical number: The average price of all 3-, 4- and 5- room resale flats in 2020 is $430,000 (rounded down from $433,363). Typically BTO flats are cheaper, because they’re subsidised by HDB.

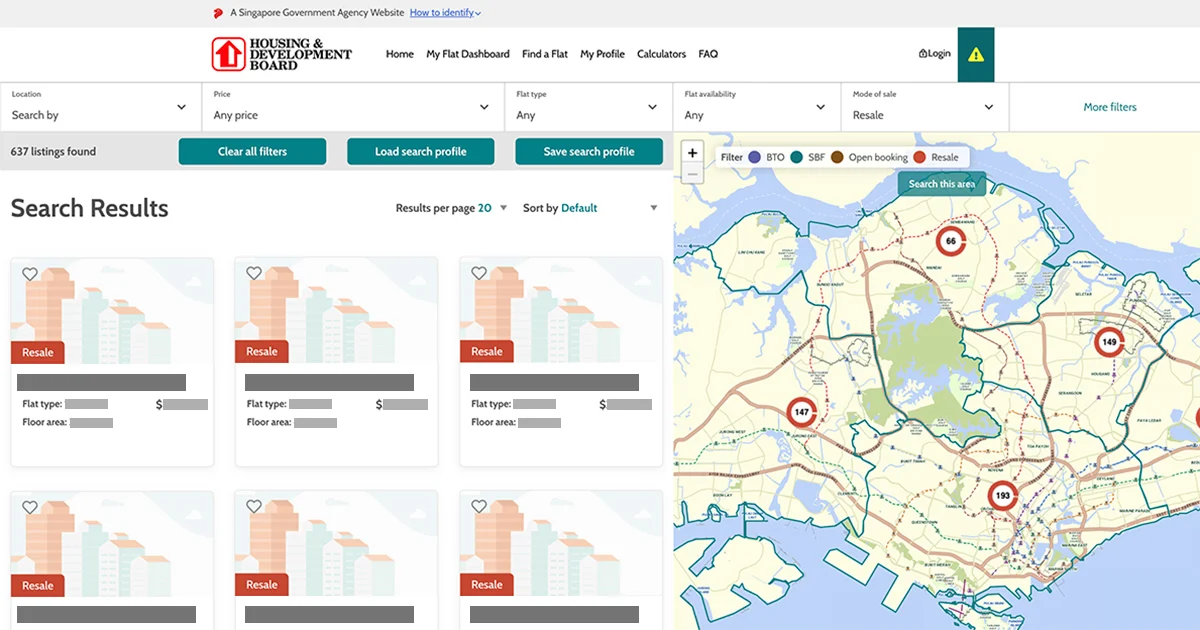

$430,000 isn’t a number we pulled out from nowhere, I’ve used paid software from 99.co (where I work) to generate this chart – it gets data from URA, REALIS and of course, 99.co.

At the same time, the median household income is $9,425.

If you spent more than $430,000 on your flat, but are earning below the median income, then you should be clear that you’re spending beyond the norm.

Same if you’re earning the median income but spent

significantly more than $430,000.

Like the 3-3-5 rule, this isn’t something you need to follow religiously, but

more of something to build self-awareness.

You’re not doomed if you ‘overspent’. But you need to recognise that you’ve spent beyond the average amount – and then work to make up for it somewhere.

| If you find all these rules restrictive, you can check out HDB’s financial planning tools to help you draw your own conclusions instead. They also have their own useful guidelines to help you make your decision. |

Of course, buying a flat is not all about money

You know what? We get it. We actually do. Money isn’t everything. Buying and owning a flat is a rite of passage, and it’s often an emotional decision. A home has feelings attached to it – feelings of belonging, love, and hope.

What’s right for you?

We are not you, so we honestly don’t know.

What can be said is this: According to the Pareto

principle, 80% of life’s outcomes are caused by the 20% of inputs.

To simplify, 20% of your choices in life will affect 80% of your life.

Your first flat that you buy in the prime of your youth?

It’s definitely in that 20%.

Stay woke, Salaryman.