Note: The information in this article has been updated on 27 August 2024.

If you’re a young first-timer couple looking to buy an HDB flat, having enough to afford a flat is probably one of the first concerns on your mind. This is especially if you are a student, full-time National Servicemen (NSF) or a recent graduate, since you are just building up your savings.

While there are no student prices for BTO flats, the good news is that there are two HDB schemes to help young couples buy an HDB flat early:

- Deferred Income Assessment: Apply for a BTO flat first, and be assessed for your eligibility to receive grants and an HDB loan later

- Staggered Downpayment Scheme: Pay a lower initial downpayment first, and pay the remaining later when you collect your keys

Read more about each of these schemes below.

? Lost on your homebuying journey? Check out our Ultimate Guide to Buying an HDB Flat for First-timers for a comprehensive overview of your housing options, grants available, and the steps involved in buying an HDB flat.

Deferred Income Assessment

Apply for a BTO flat first, and get assessed for your eligibility to receive grants and an HDB loan later

Who is it for?

The Deferred Income Assessment helps young couples who are buying a new flat from HDB (such as a BTO flat or SBF flat). Both of you will need to be either full-time students, NSF, or have completed full-time studies or National Service within the last 12 months before your HFE letter application.

The full eligibility conditions can be found on HDB InfoWEB.

How does it work?

With the Deferred Income Assessment, you and your fiancé/fiancée may apply for a flat first. You can then be assessed for your eligibility to receive an Enhanced CPF Housing Grant and an HDB loan closer to key collection. Because grant and loan eligibility are usually dependent on household income, deferring your income assessment is helpful if you and your fiancé/fiancée have not started working yet, or have just started working. By the time you collect your keys, you would have been working for some time – this means you are likely to be eligible for grants, and also qualify for a higher loan amount.

? Eligible first-timers buying BTO flats can receive the Enhanced CPF Housing Grant of up to $120,000. Learn more in our Guide to CPF Housing Grants.

Staggered Downpayment Scheme (SDS)

Pay a lower initial downpayment first, and pay the remaining later when you collect keys

Who is it for?

You can qualify for the SDS if:

- Both of you are first-timers, or one of you is a first-timer and the other is a second-timer

- You applied for an HFE letter on or before the younger applicant’s 30th birthday

- You booked an uncompleted 5-room or smaller flat in any of HDB’s sales launches

The full eligibility conditions can be found on HDB InfoWEB.

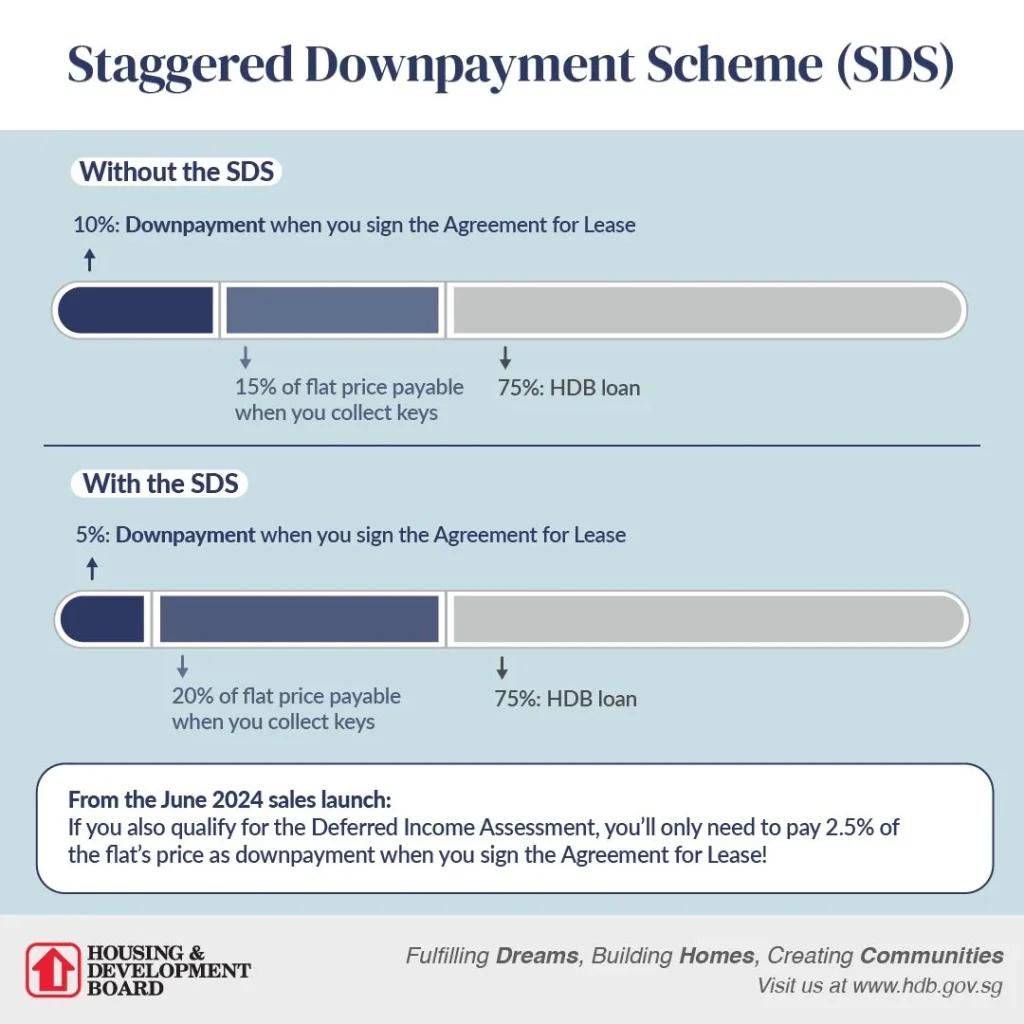

How does it work?

With the SDS, you can pay a lower downpayment when you sign the Agreement for Lease. How much you will need to pay depends on:

- The loan type you take up (i.e. HDB or bank loan)

- If you qualify for the Deferred Income Assessment

You can pay the remaining downpayment when you collect your keys instead, meaning more time to save up!

Here’s a worked example, assuming you’re taking an HDB loan:

To see the full breakdown of downpayment by loan type and scheme, visit the HDB InfoWEB.

Looking for more financial planning tips? Follow us on Instagram at @SingaporeHDB for more home buying advice!